Mark Croxon, Co-Founder, Reifi Consulting and Co-Author for CMX

Recently, I had the pleasure of moderating a highly insightful panel discussion at CMX on the topic of Cross-Asset O/EMS Acceleration.

The event featured distinguished guests: Liakos Papapoulos, Trading and Technology Expert at LP Trading Innovation and Advisory Services; David Shack, VP of Trading Technology at Fidelity International; and Ravi Sawhney, Global Head of Buy Side Execution at Bloomberg. Together, we explored the intricacies of Order Management Systems (OMS) and Execution Management Systems (EMS), and their integration, to streamline trading operations.

The significance of this topic cannot be overstated. As trading environments become increasingly complex and Multi-Asset trading becomes the norm, optimising and integrating OMS and EMS are paramount for operational efficiency, cost reduction, and improved execution. Here, I will recap the key discussions and unique insights from our panel, and provide practical strategies that emerged during the conversation.

Key Discussions and Insights

Maximising OMS Potential

Our panel kicked off with a discussion on strategies to maximise the potential of OMS. We highlighted that firms could achieve significant efficiency gains by streamlining order processes and reducing manual interventions. We added that integrating advanced data analytics into OMS can provide real-time insights, helping traders make more informed decisions. The panel shared perspectives on the importance of compliance and how an optimised OMS can ensure adherence to regulatory requirements seamlessly.

Bridging the Gap between OMS and EMS

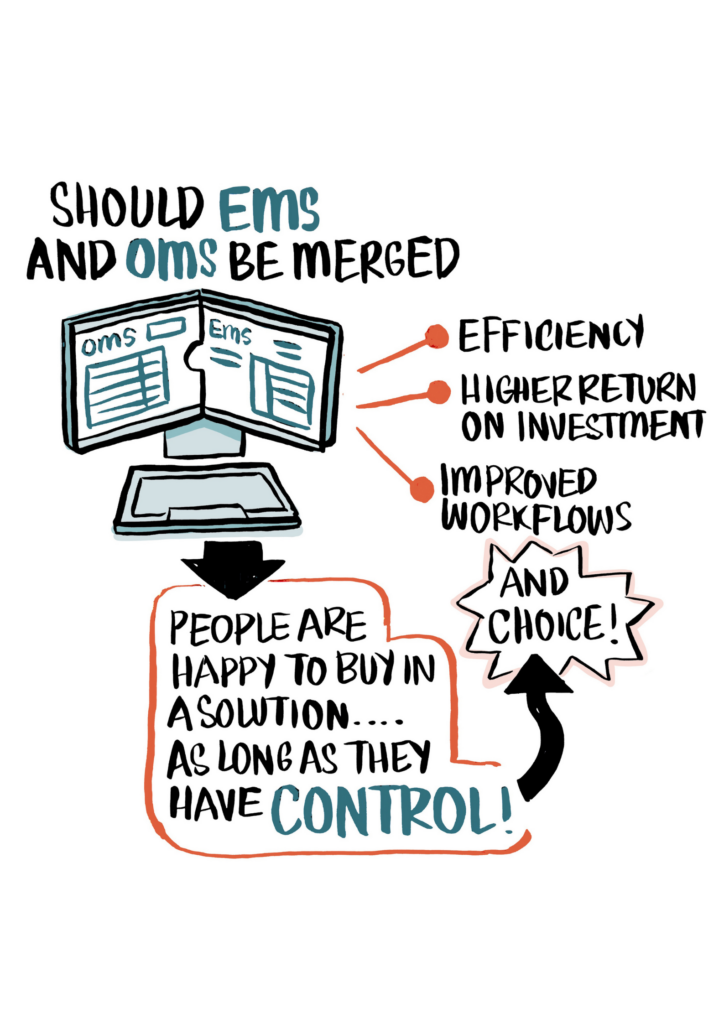

One of the central themes was bridging the gap between OMS and EMS. We agreed that the convergence of these systems is crucial for a seamless trading experience and mentioned that many firms are now prioritising this integration to eliminate redundant processes and reduce operational costs. The panel elaborated on how firms have been working towards this integration, with some leveraging cutting-edge technology to unify order and execution workflows.

Reducing Linkages and Costs

A critical part of the discussion was on reducing linkages and associated costs for seamless trading systems. The panel highlighted the importance of a holistic approach, where firms assess their entire trading infrastructure to identify and eliminate unnecessary linkages. We emphasised that integrating OMS and EMS can lead to significant cost savings by reducing the need for multiple platforms and decreasing maintenance overheads, and shared successful case studies where firms achieved substantial cost reductions and operational efficiencies through strategic integrations.

Evolutionary OMS and Emulating EMS Capabilities

We delved into the evolution of OMS and how it can be transformed to emulate EMS capabilities. It was explained that an evolutionary OMS needs to be adaptive, integrating real-time data and advanced algorithms to provide functionalities typically associated with EMS. We looked at a use case to illustrate the journey towards this transformation, detailing the challenges and successes experienced.

The panel then highlighted emerging trends, such as AI and machine learning, which are increasingly being incorporated into OMS to enhance capabilities and provide a more streamlined trading experience.

Implementable Strategies

Strategy 1: Streamline Order Processes

Firms should focus on automating routine tasks within their OMS to reduce manual interventions and errors. Implementing advanced data analytics can provide real-time insights, enhancing decision-making capabilities. Regular audits of OMS processes can help identify inefficiencies and areas for improvement.

Strategy 2: Integrate OMS and EMS

Achieving a seamless integration between OMS and EMS is critical. Firms can start by conducting a thorough assessment of their current systems to identify redundant processes and potential integration points. Investing in technologies that facilitate this convergence, such as API-driven platforms, can significantly enhance operational efficiency.

Strategy 3: Leverage Advanced Technologies

Incorporating advanced technologies like AI and machine learning into OMS can transform them to emulate EMS capabilities. These technologies can help with real-time data processing, predictive analytics, and automated decision-making, providing a more sophisticated and efficient trading environment.

Strategy 4: Focus on Cost Reduction

Reducing operational costs is a primary benefit of integrating OMS and EMS. Firms should evaluate their existing trading infrastructure to identify and eliminate unnecessary linkages. Consolidating systems and processes can lead to significant cost savings and improved operational efficiency.

Conclusion

The panel discussion underscored the importance of accelerating cross-asset O/EMS integration to achieve operational efficiency, cost reduction, and improved trading performance. By adopting the strategies and insights shared by our expert panellists, firms can navigate the complexities of modern trading environments more effectively.

I encourage our community to implement these strategies and leverage the discussed technologies to enhance their trading operations. For those interested in further exploration, numerous resources and case studies are available that delve deeper into the integration and optimisation of OMS and EMS.

This panel provided a wealth of knowledge, and I look forward to seeing how our community applies these insights to drive innovation and efficiency in their trading practices…